| Location | Deposit Type | Commodities | Size | Status |

|---|---|---|---|---|

| North-central British Columbia | Cu-Au porphyry | Cu-Au | 7,500 | 100% Ownership |

Red Lion: A Highly Prospective Cu-Au Porphyry Project In North-Central B.C.

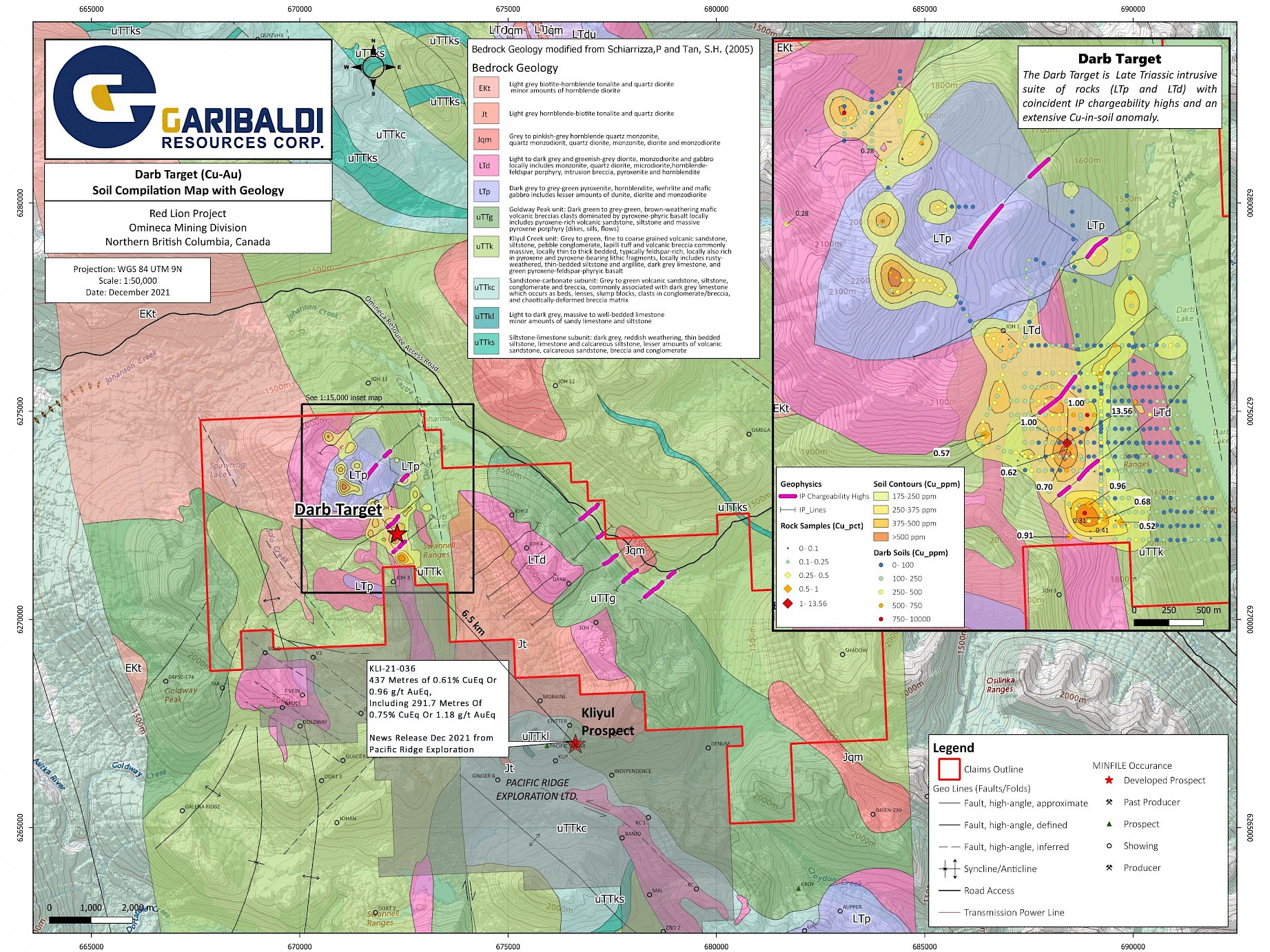

Extensive geophysical, geochemical and surface sampling programs have produced a near drill ready Cu-Au porphyry target. The Darb Target is Late Triassic intrusive suite of rocks with coincident IP chargeability highs and an extensive Cu-in-soil anomaly greater than 1200m long x 400m wide and remains open. Two additional IP chargeability highs remain to be tested with geochemical surveys. The host rocks at the Red Lion and Darb Target are known to host multiple significant Cu-Au porphyry deposits.

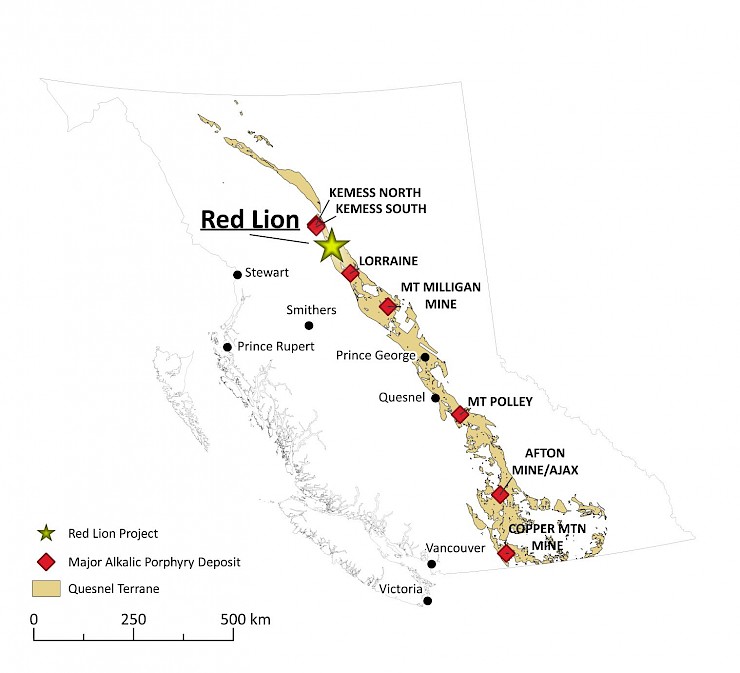

The Red Lion “Corridor” is parallel to the Omineca mining road and power lines to Kemess that strategically pass through the property claims.

The Red Lion, never previously drilled, was gradually expanded to 75 sq. km from the original 35 sq. km acquired by Garibaldi in early 2014. The property is drill ready and contiguous to the Kliyul Project to the south. The Kemess mine is located approximately 60 km to the northwest and is underlain by the same lithological units as the Red Lion.

The Red Lion Corridor:

There are three major target areas along the Red Lion Corridor:

- The Darb Target: A chargeability high, 1.8 km long, coincides with anomalous copper-gold rock, soil and stream sediment results and a magnetic high underlain by a diorite intrusive.

- An extensive copper-in-soil anomaly at the Ridge target stretches northwest-southeast for 4.2 km and east-west for 400 meters to 800 meters within a broader anomaly up to 1.7 km wide.

- Parallel to the east of this large geochemical anomaly is a 2.4-km-long induced polarization chargeability high, open to the north and south, that continues up slope from the Omineca road. The IP high coincides with anomalous copper-gold rock, soil and stream sediment results along with a magnetic high that is known to be underlain by a diorite to a monzodiorite intrusive in a largely overburden-covered area (RL East target).

Chip Samples Return 37.5 g/t Au, 13.6% Cu, 0.55% Co

Significantly, the four chip samples at Darb Target with the highest measured chargeability were associated with abundant pyrite and assayed the highest grades in gold, copper and cobalt. Those values ranged from 1.07 g/t Au to 37.5 g/t Au, 0.21% Cu to 13.6% Cu, and anomalous Co to 0.55% Co. Extensive outcropping exists at Darb, and numerous areas have yet to be sampled. The fact that the chargeability high appears to be related to sulphides carrying mineralization is extremely encouraging.

The IP chargeability highs at Red Lion are similar to those measured at the adjoining Kliyul Property.

Geology

The Red Lion property is underlain by Upper Triassic Takla Group rocks comprising a lower unit of volcaniclastic sedimentary rocks overlain by volcanic breccias and flows. These units are intruded by various intrusive suites, and copper and gold mineral occurrences are typically associated with Late Triassic monzodioritic plutons and their related dikes. North-northwest trending faults have been mapped on the property and strongly-developed jointing has been noted with north-northwest and northeast orientations.

Potential

Steve Regoci, Garibaldi President and CEO, commented: “The Red Lion has proven to be an exceptional acquisition that we picked up at the right price at a low point in the resource sector. The quality of these targets that have been systematically identified over a 10-km-long corridor speaks to the Red Lion’s exciting exploration upside. Surrounding infrastructure and the prolific nature of the Quesnel trough district make the Red Lion even more compelling. We are currently examining all options to unlock the full value of this significant asset for Garibaldi shareholders.”

July 2019 Red Lion Assessment Report